Leveraged Trading

John Carls

Last Update 3 年前

What is leveraged trading

Leverage trading is an investment method that uses small amounts of capital to obtain several times the original amount of capital. Users borrow a small number of digital tokens and do long (buy)/short (sell) operations to expand the investment amount and improve the utilization rate of funds. There are a few important points you need to know before you start a leveraged trade.

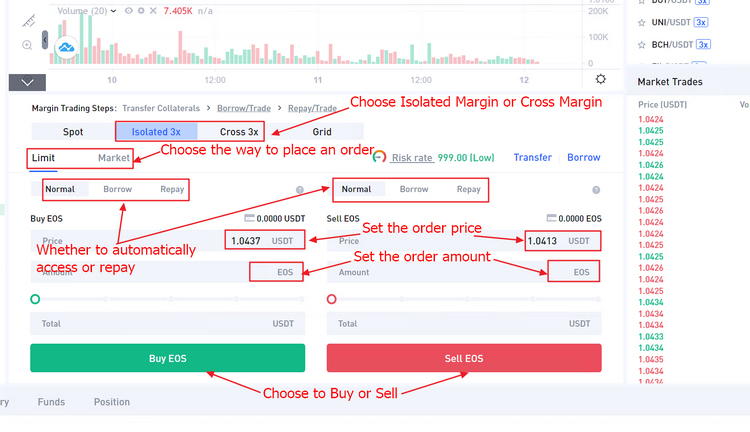

Full Position Leverage and Per-position Leverage

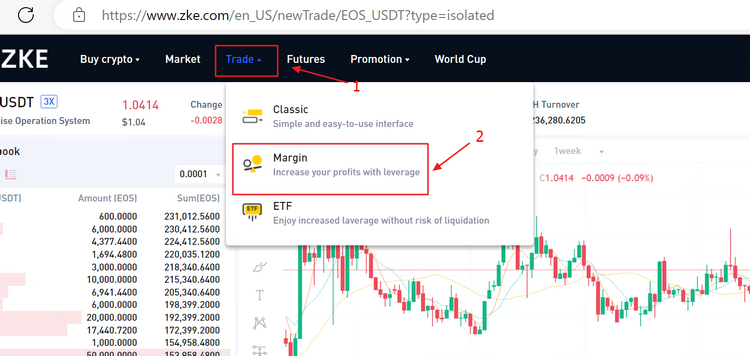

ZKE platform supports two trading modes: full position leverage and leverage by position.

Full Position Leverage

Full position leverage means that all assets in the leveraged account (regardless of currency type) will be used as a margin to improve the utilization rate of funds and avoid the risk of forced liquidation to the greatest extent. The advantage of full leverage is that you don't need to be forced to replace tokens you already own to borrow in another currency; All currencies supported by full position leverage can be transferred to the full position leverage account as margin; The whole full position account as one position; There's only one debt ratio; Currently, the maximum leverage multiple of 3x is supported (the specific maximum support platform will be adjusted according to the business, please go to the market to check).

Per-position Leverage

Leverage means that each leveraged transaction has an independent leveraged account, with independent transactions, independent risks, and independent calculation of debt ratio. You can only transfer, hold, or lend in two currencies of a trading pair in a particular open account. The benefit of leverage: isolation of risk. Once there is a risk of liquidation, there will be no impact on other liquidation accounts; The maximum available leverage multiple varies from pair to pair. Position leverage currently supports a maximum of 3x leverage multiple (the platform will adjust the specific maximum leverage multiple according to the business, please check in the market).

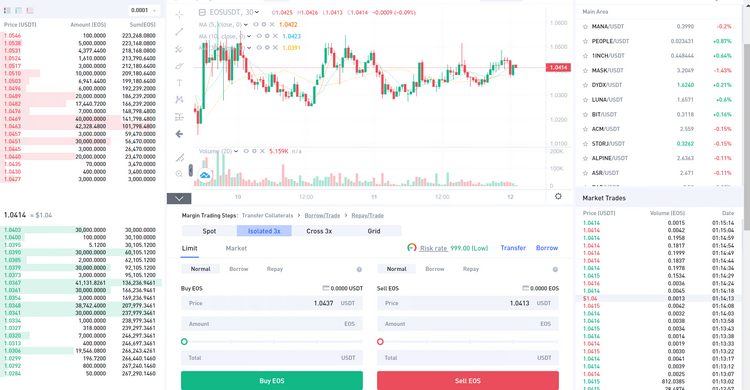

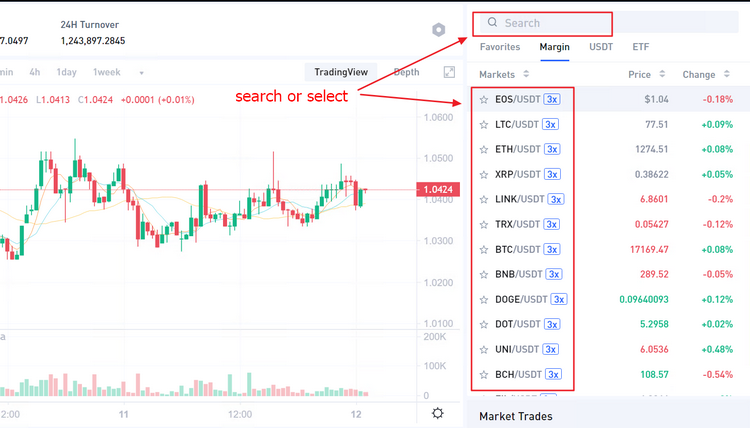

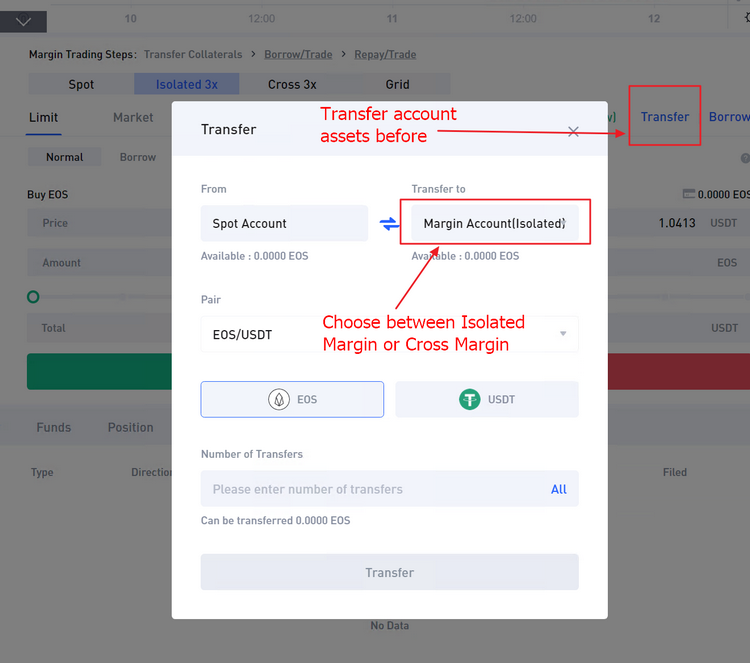

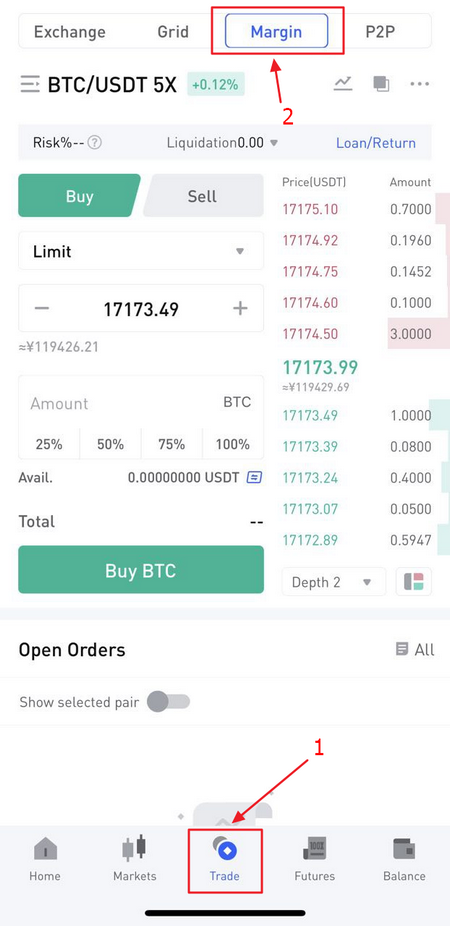

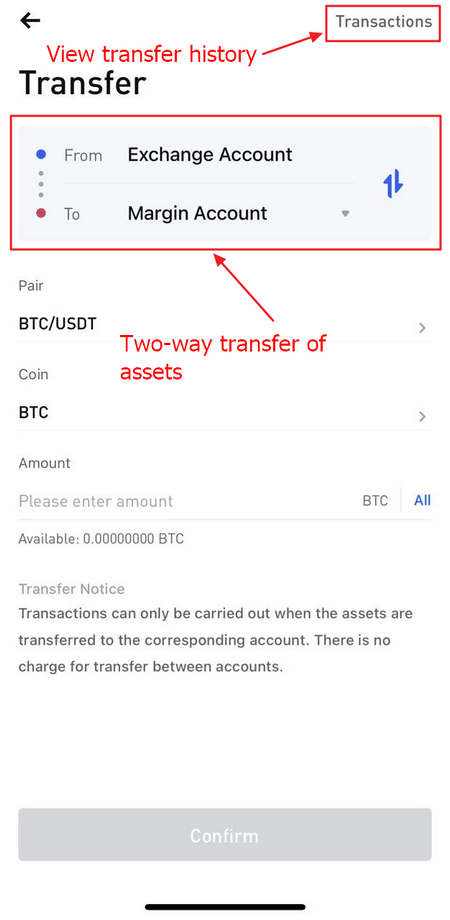

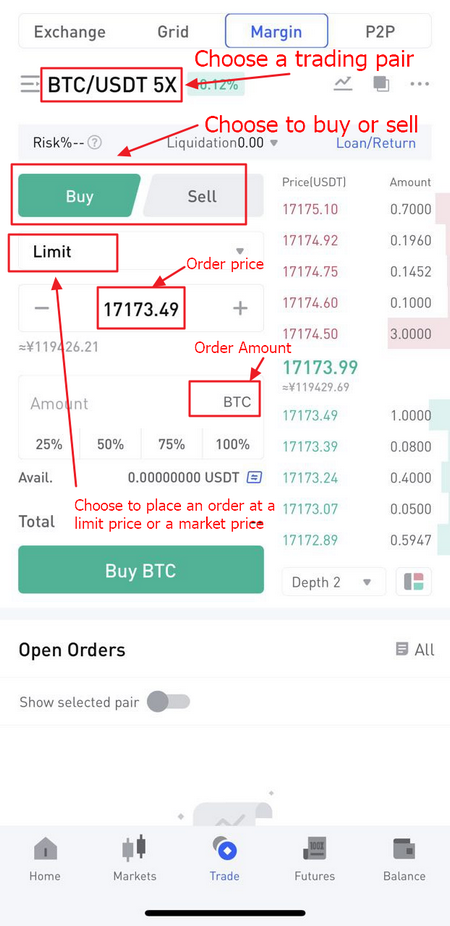

After the leverage trading interface appears, the supported leverage trading pairs will be displayed in the list on the right. ZKE currently supports 3X leverageTransfer account assets before margin trading;

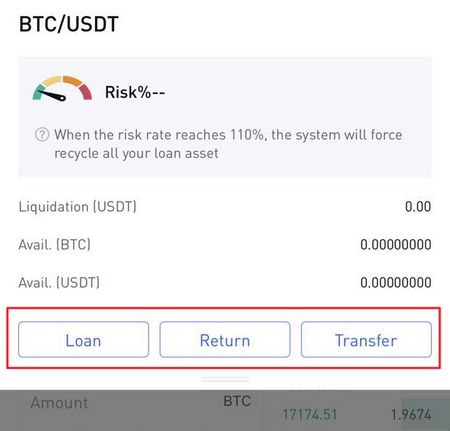

Bond calls to transfer more money from other accounts to leveraged accounts;

Early repayment of some of the debt.

Tips:

The debt ratio is calculated using market prices.

Leveraged trading is a kind of activity with high market risk, which may bring you huge gains, but also make you make huge losses. Past earnings are not indicative of future returns. Violent price movements may result in the forced liquidation of all your assets. The information provided herein should not be construed as financial or investment advice. All trading strategies are at your sole discretion and risk. The Platform is not liable for any losses you may incur as a result of your use of leverage.